Written by

Fazila MalikLast updated on:

January 28, 2025Reading time:

Contents

Built for Security. Loved by Devs.

- Free Trial — No Credit Card Needed

- Full Access to All Features

- Trusted by the Fortune 100, early startups, and everyone in between

Financial services companies handle a vast amount of sensitive data, including the personal and financial information of their customers. This makes them a prime target for hackers and cybercriminals who want to steal that data.

Hackers are constantly finding new ways to break through the walls of enterprise environments. If successful, they can cause serious problems like identity theft or fake transactions, impacting individuals and companies financially.

To fight back, financial services companies need to beef up their approach to cybersecurity. Investing in advanced technologies and regularly assessing vulnerabilities helps enterprises protect themselves and their customers from potential breaches before hackers strike, keeping everyone’s funds safe.

Introduction to Financial Services Cybersecurity

In the financial services sector, the increasing dependence on technology and interconnectedness of financial systems increases the risk of cyber attacks. Cybersecurity in the financial sector is all about keeping your financial data safe from unauthorized access, theft, and tampering, just like having locks and alarms on a bank vault. Having strong financial services cybersecurity measures in place helps prevent scams and keeps everything running smoothly, so your customers can still access money when they need it.

Government agencies like the SEC and the Federal Reserve set strict regulations to make sure banks and other financial companies keep customer information safe. Compliance with these regulations isn't just about avoiding big fines — it's also about keeping customer and stakeholder trust and confidence in the system.

Common Cybersecurity Risks in the Financial Sector

Financial institutions are prime targets for cyber attacks due to the valuable information they possess. Here are some of the most common risks faced in cybersecurity for financial services:

Data breaches: Financial institutions store vast amounts of sensitive information, including clients’ personal and financial data. A data breach can result in severe financial loss, reputational damage, and legal consequences.

Phishing and social engineering attacks: Phishing attacks involve tricking individuals into revealing their personal information, such as login credentials or credit card details. Your customers may face targeted phishing attacks, which can compromise your cybersecurity for financial services and lead to unauthorized access to accounts and financial fraud. Cybercriminals may also use social engineering techniques, such as pretexting or baiting, to manipulate customers into disclosing confidential information or performing actions that compromise security.

Ransomware: Ransomware is a type of malicious software that encrypts a victim's files and demands a ransom in exchange for their release. Your organization is an attractive target for ransomware attacks due to the potential for large financial payouts.

Distributed Denial of Service (DDoS) attacks: DDoS attacks disrupt services by overwhelming systems, networks, or websites with a flood of traffic, rendering them inaccessible to legitimate users. You may be targeted with DDoS attacks to disrupt operations, extort ransom payments, or distract security teams while other cyberattacks are carried out.

Third-party risks: You probably rely on third-party vendors, service providers, or partners for various functions, such as cloud services, payment processing, or building a data analytics platform to gain insights from financial data. These third parties may introduce risks, due to inadequate financial services cybersecurity practices, vulnerabilities in their systems, or supply chain attacks, which can compromise the security of your data and operations.

Insider threats: Whether intentional or accidental, insiders with access to sensitive information pose a risk that can result in data breaches, financial fraud, and other consequences.

Regulatory and compliance risks: Non-compliance with regulations and industry standards such as the Payment Card Industry Data Security Standard (PCI DSS), the Gramm-Leach-Bliley Act (GLBA), or the European Union's General Data Protection Regulation (GDPR) can expose your institution to legal and regulatory sanctions, fines, and reputational damage.

Challenges Addressing Financial Services Cybersecurity Risks

Addressing financial sector cybersecurity risks comes with its fair share of challenges, including:

System complexity: Your organization has complex IT systems made up of various interconnected applications and databases. Managing cybersecurity across these systems can be complicated and vulnerabilities in one area can have a cascading effect on the entire network.

Regulatory compliance: You must comply with a multitude of financial services cybersecurity regulations while also maintaining operational efficiency.

Emerging threats: Cyber threats are constantly evolving, with new attack vectors and techniques emerging regularly. Staying ahead of these threats and adapting security measures accordingly is an ongoing challenge.

Balancing security and user experience: You need to strike a balance between implementing robust financial services cybersecurity measures and providing a seamless user experience. Stringent security measures can hinder user convenience, leading to friction and potential customer dissatisfaction.

Cybersecurity Solutions for Financial Institutions

To combat the ever-growing risks for cybersecurity for financial services, you must adopt a multi-layered approach to security. Here are some essential solutions for cybersecurity in the financial sector that can help safeguard your institution:

Multi-factor Authentication (MFA) and Endpoint Security

Implementing MFA adds an extra layer of security by requiring your users to provide multiple forms of authentication — like entering a code from their phone — before granting access. Endpoint security ensures that all devices connected to the network, such as laptops, servers, and mobile devices, are secure and protected against unauthorized access. Endpoint security can include the use of antivirus and antimalware solutions, firewalls, intrusion detection and prevention (IDP) systems, data loss prevention (DLP) tools, and other solutions. The goal of endpoint cybersecurity in the financial sector is to keep your perimeter devices secure, preventing attacks.

💡Make it easy: StrongDM integrates seamlessly with MFA solutions, ensuring that any device used to access the network is authenticated. StrongDM enables you to require users to complete MFA to gain access to sensitive resources, ensuring that access is granted only when secure.

Encryption

Encryption provides an extra layer of defense against cyberattacks and is a critical component of cybersecurity for financial services, whether your data is transmitted over a network or stored on a device. Encryption protects data by converting it from a plaintext format to an unreadable format that requires a unique digital key to read. Encrypting sensitive information ensures that even if your data is compromised, it remains unreadable and unusable to unauthorized individuals. In most cases, encryption can be used for authentication, ensuring that data hasn’t been tampered with during transmission.

💡Make it easy: StrongDM ensures that all data in transit is encrypted using industry-standard protocols, providing robust protection against eavesdropping and ensuring that sensitive financial data remains confidential.

Secure Configuration and Patch Management

Implementing secure configurations ensures that your systems are set up with the necessary security measures from the start. Since attackers are constantly developing new techniques and tools to exploit software vulnerabilities, regularly updating and patching software and systems maintain security by providing fixes for known vulnerabilities. Patches and updates not only close down potential entry points for attackers, they also ensure that your systems run the latest software, minimizing the risk of system crashes and downtime.

💡Make it easy: While StrongDM itself is a tool for access management, it supports secure configurations by ensuring that only authenticated and authorized users can access systems and networks. This helps maintain the integrity of your system configurations and reduces the risk of unauthorized changes that could lead to vulnerabilities.

Data Loss Prevention (DLP)

DLP solutions help identify and prevent the unauthorized transmission of sensitive data in both on-premises and cloud-based locations. You can use these financial services cybersecurity solutions to detect and block attempts to send confidential information via email, file transfers, or other communication channels, helping you meet compliance requirements like the Health Insurance Portability and Accountability Act (HIPAA).

💡Make it easy: By controlling and monitoring access to data and resources, StrongDM helps prevent unauthorized access and potential data leaks. It ensures that only the right people have the right access, reducing the risk of data loss or exposure.

Security Information and Event Management (SIEM)

SIEM is a combination of services and software used for security event management (SEM) and security information management (SIM). SIEM solutions collect and analyze security event logs from various systems and applications in real time, so you can detect and respond to potential security incidents promptly before they disrupt business operations. Additionally, gaining visibility into network activity helps meet compliance requirements.

💡Make it easy: StrongDM can integrate with existing SIEM systems to provide detailed logs and audit trails of all database and server access. This enhances your ability to detect, analyze, and respond to financial services cybersecurity threats in real time.

Incident Response and Recovery Plans

A well-defined incident response plan helps effectively manage incidents involving cybersecurity for financial services before, during, and after an incident. You should have a clear roadmap that classifies what an incident is, who is responsible for responding, roles and responsibilities, documentation, and reporting requirements. Your plan should also outline how you’ll respond to and recover from security breaches to minimize the impact on your operations and customers.

💡Make it easy: StrongDM contributes to incident response and recovery by providing comprehensive access logs and audit trails, which can be crucial for investigating and resolving security incidents. StrongDM also provides robust analytics with a reports library, making it easy to understand who is exactly doing what at any given time.

Regulatory Compliance Management

Implementing a comprehensive compliance management system ensures that all necessary controls and processes are in place to meet regulatory requirements for financial services cybersecurity. Regulatory compliance ensures that your organization adheres to financial services compliance regulations, standards, and laws such as HIPAA, PCI-DSS, and GDPR. Meeting these requirements protects sensitive information and avoids legal penalties while maintaining customer trust and improving your overall security posture.

💡Make it easy: StrongDM helps financial institutions meet various regulatory compliance requirements by providing detailed access controls and audit trails, and ensuring that only authorized individuals can access sensitive information, thereby aiding in compliance with regulations like PCI DSS, GDPR, and others.

Zero Trust Architecture

Zero Trust is a core principle of cybersecurity in the financial sector. It assumes that every user, device, and network is potentially compromised and requires authentication and verification at every step. With a Zero Trust architecture, you reduce risk by following three core principles: never trust anyone until they’ve been verified, assume that a breach has already occurred or is inevitable, and apply least privileged access by only granting minimum privileges to perform the job. Zero Trust security also constantly monitors for malicious activity, minimizing the risk of unauthorized access and lateral movement within the network.

💡Make it easy: StrongDM aligns with the principles of a Zero Trust architecture by never assuming trust and always verifying every access request. Policy-based action control ensures real-time, verifiable Zero Trust compliance. This ensures that access is securely managed and monitored, reducing the risk of insider threats and external attacks.

Address Financial Services Cybersecurity Needs with StrongDM

Implementing individual solutions for cybersecurity in the financial sector is crucial to your financial institution. However, you’ll gain more from a centralized access control solution like StrongDM. StrongDM has these features that address your specific financial services cybersecurity needs:

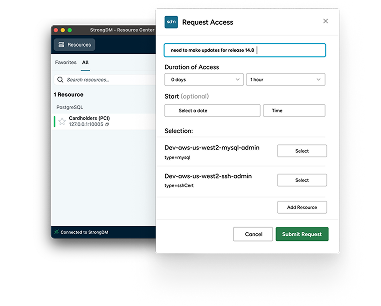

Centralized access control: StrongDM provides a centralized platform for managing access to critical resources on-premises and in the cloud. It allows your organization to enforce granular access controls, ensuring that only authorized individuals can access sensitive data and systems.

Monitoring and logging for compliance and auditing: StrongDM offers robust monitoring and logging capabilities, tracking every activity and query. Get detailed insights into user activities that help meet regulatory compliance requirements and enable efficient auditing processes.

Seamless integration with existing security tools: StrongDM’s cybersecurity for financial services seamlessly integrates with existing security tools This eliminates the need for extensive changes or disruptions, simplifying the implementation process and ensuring a smooth transition to a centralized access control system.

Real-time threat detection and response capabilities: StrongDM's real-time monitoring capabilities allow you to detect and respond to potential security threats promptly and help mitigate the risk of data breaches and other cybersecurity incidents.

Financial services cybersecurity is a critical aspect of your organization’s success. Safeguard your operations, reputation, and customer trust with StrongDM’s comprehensive access control solution that addresses the specific needs of financial institutions, ensuring secure access to your critical resources. Learn more about controlling access to your resources with a demo of StrongDM today.

Next Steps

StrongDM unifies access management across databases, servers, clusters, and more—for IT, security, and DevOps teams.

- Learn how StrongDM works

- Book a personalized demo

- Start your free StrongDM trial

Categories:

About the Author

Fazila Malik, Sales Enablement Expert, as an accomplished Product Marketing Manager in the technology industry with over 5 years of experience, Fazila transitioned to a Sales Enablement leader position passionate about empowering go-to-market teams to excel in their roles. Throughout her career, she has worked with a range of technology products, including software applications and cloud-based solutions. Fazila is a member of the Product Marketing Alliance and an AWS Cloud Certified Practitioner. To contact Fazila, visit her on LinkedIn.

You May Also Like