15 Cybersecurity Regulations for Financial Services in 2026

Written by

John MartinezLast updated on:

January 15, 2025Reading time:

Contents

Built for Security. Loved by Devs.

- Free Trial — No Credit Card Needed

- Full Access to All Features

- Trusted by the Fortune 100, early startups, and everyone in between

Regulatory compliance in the financial services industry is an always-on, Sisyphean task that, if not managed correctly, could lead to significant damage to enterprises and their users. If you’re feeling the strain of balancing daily operations with pressing regulatory demands, you’re not alone. Many firms worry they’re falling behind: A 2024 study found that 70% of financial organizations now believe they’re underspending on cybersecurity, up from 58% in 2020.

The pressure to adapt to regulations and implement effective technologies in time to avoid violations, penalties, and fines can seem intense. However, a practical, clear-sighted approach can help cut through confusion, help organizations remain compliant with ease, and boost operational efficiency and customer trust.

In this guide, we’ll cover the 15 most important cybersecurity regulations for financial services providers. We’ll show exactly which ones—from GDPR and PCI DSS to MAS TRM, CBEST, and others—apply to your organization, and explain, in plain in English, what they are, how they impact your business, and how you can initiate a path for compliance.

Overview of FinServ Regulations by Region

- United States Regulations (go to this section)

- European Union Regulations (go to this section)

- UK Regulations (go to this section)

- Asia-Pacific Regulations (go to this section)

- Global/Industry-Specific Frameworks (go to this section)

The Benefits of Cybersecurity Regulations for Financial Services

As burdensome as cybersecurity regulations can seem, remember that they exist to defend not only consumers, but also organizations like yours, from threats and breaches. Financial services institutions are a common high-value target for cyber criminals.

Financial firms lose approximately $6.08 million per data breach, 25% higher than the global average of $4.88 million—and breaches have only grown more frequent and sophisticated.

Many regulatory requirements are just good-sense cybersecurity practices anyway. This helps explain why 70% of companies say compliance has helped them mature their cybersecurity capabilities overall.

Understanding these regulations is more than a legal necessity—it’s your blueprint for stronger cybersecurity, greater customer trust, and a seal of supervisory approval. Let’s now break down what each framework requires and why it matters, and also look at practical steps to streamline compliance, manage audits, and implement security measures that protect your organization.

United States Regulations

1. New York Department of Financial Services (NYDFS) Cybersecurity Regulation (23 NYCRR 500)

Origins and Relevance: Enacted in 2017, the NYDFS Cybersecurity Regulation sets rigorous cybersecurity standards for financial establishments operating in New York. As one of the first comprehensive state-level cybersecurity regulations, it is now a model for other states. The regulation applies to all entities regulated by NYDFS.

Compliance Challenges: Compliance with NYDFS can be resource-intensive, especially for smaller organizations, as it requires dedicated cybersecurity personnel, regular risk assessments, and advanced reporting capabilities. Organizations often need to invest in governance tools and incident response mechanisms to meet these requirements.

Impact on Cybersecurity Posture: The regulation significantly strengthens an organization's cybersecurity resilience by requiring robust measures like multifactor authentication, encryption, and third-party risk management. It also improves organizational awareness of cyber risks through mandatory risk assessments and board-level involvement in cybersecurity strategies.

- Key Objectives: To ensure financial services organizations develop robust cybersecurity programs to protect customer data and reduce cyber threats.

- Mandatory or Voluntary: Mandatory for regulated entities.

- Who It Applies To: Any entity regulated by the NYDFS, including banks, insurance companies, providers of mortgage loans or services like licensed lenders or private bankers; also included are foreign banks given licenses to do business in New York. It also indirectly applies to third-party service providers handling data for covered entities. Some exemptions are possible for smaller entities.

- Penalties for Non-Compliance: Fines typically range from $1,000 to $250,000 per violation, or more based on the extent of non-compliance. For instance, EyeMed Vision Care was fined $4.5 million for violating NYDFS cybersecurity standards.

- Helpful Resources:

How to Meet NYDFS Section 500.7 Amendment Requirements

2. Payment Card Industry Data Security Standard (PCI DSS)

Origins and Relevance: Created by the Payment Card Industry Security Standards Council, PCI DSS assures safe processing, storage, and transmission of cardholder data. For businesses dealing with credit or debit card transactions, including merchants, payment processors, and service providers, it is a critical industry standard.

Compliance Challenges: Achieving compliance can be complex due to detailed requirements covering areas such as network segmentation, access control, and vulnerability management. Smaller businesses may have trouble with the cost and technical aspects of compliance.

Impact on Cybersecurity Posture: PCI DSS drives organizations to adopt robust security frameworks, reducing the risk of breaches. Its focus on encryption, vulnerability scanning, and secure application development strengthens an organization's overall security operations and incident response capabilities.

- Key Objectives: To secure credit card transactions and protect cardholder data from breaches.

- Mandatory or Voluntary: Mandatory for organizations processing, storing, or transmitting credit card data under agreements with card networks.

- Who It Applies To: Any business globally that handles payment card information, including retailers, financial institutions, and service providers.

- Penalties for Non-Compliance: Fines range from $5,000 to $100,000 per month of non-compliance, and card issuers can revoke privileges. Target’s 2013 breach, which was tied to PCI DSS non-compliance, ultimately cost the retailer $292 million – and could have been prevented with proper compliance.

- Helpful Resources:

PCI DSS Compliance Guide

PCI Compliance Checklist: The 12 Requirements

How StrongDM Helps with PCI DSS 4.0 Compliance

3. Federal Financial Institutions Examination Council (FFIEC)

Origins and Relevance: The FFIEC, formed in 1979, develops uniform principles and standards for federally regulated financial institutions, including banks, credit unions, and their third-party service providers. It ensures the safety and soundness of the U.S. financial system. Its Cybersecurity Assessment Tool (CAT) helps institutions identify and mitigate cyber risks.

Compliance Challenges: Implementing FFIEC recommendations requires detailed documentation and ongoing cybersecurity maturity assessments. Organizations often need to dedicate resources to meet these standards.

Impact on Cybersecurity Posture: Adhering to FFIEC guidance fosters a proactive cybersecurity culture by promoting risk identification, board-level awareness, and robust incident response planning. It also encourages institutions to continuously improve their cybersecurity defenses.

- Key Objectives: To provide standards for IT security, risk management, and incident response for financial institutions.

- Mandatory or Voluntary: Mandatory for U.S. financial institutions regulated by FFIEC member agencies. Note that use of CAT for aiding compliance is voluntary.

- Who It Applies To: Federally regulated banks, credit unions, financial institutions, and their third-party service providers.

- Penalties for Non-Compliance: FFIEC member agencies may enforce penalties, including fines and loss of charters, depending on the severity of non-compliance. For example, in 2020, FFIEC member agency Office of the Comptroller of the Currency (OCC) fined Citibank $400 million for inadequate risk management, data governance, compliance risk management, and internal controls.

- Helpful Resources:

FFIEC Cybersecurity Resource Center

Ensure Secure Access and Mitigate Threats to FFIEC Controls

4. Gramm-Leach-Bliley Act (GLBA)

Origins and Relevance: Passed in 1999, GLBA aims to protect the personal financial information held by U.S. financial institutions, including banks, insurance companies, and investment firms, as well as their third-party service providers. Its Safeguards Rule requires organizations to implement a comprehensive information security program.

Compliance Challenges: Smaller firms may find compliance challenging due to the need for detailed data inventories, ongoing risk assessments, and third-party oversight.

Impact on Cybersecurity Posture: GLBA strengthens data protection measures by emphasizing the need for secure handling of customer data. It helps organizations adopt systematic risk management practices, enhancing their overall security framework.

- Key Objectives: To require financial institutions to protect consumers' private financial data.

- Mandatory or Voluntary: Mandatory for financial institutions in the U.S.

- Who It Applies To: U.S. banks, insurance companies, investment firms, and other financial institutions. Also applies to service providers handling their data.

- Penalties for Non-Compliance: Fines up to $100,000 per violation for institutions and $10,000 for officers and directors. Penalties can also include imprisonment for up to five years for willful violations.

- Helpful Resources:

GLBA Compliance Guide

European Union Regulations

5. General Data Protection Regulation (GDPR)

Origins and Relevance: Enforced in 2018, GDPR is a landmark regulation that protects the privacy and personal data of EU citizens, regardless of its location globally. It has influenced global data protection laws, making it a critical regulation for organizations worldwide.

Compliance Challenges: GDPR compliance is complex, involving strict requirements for consent management, data breach notifications, and data minimization. Companies must also appoint Data Protection Officers (DPOs) if handling significant amounts of personal data.

Impact on Cybersecurity Posture: GDPR encourages organizations to adopt privacy-by-design principles, secure data storage, and encryption. It also increases awareness of data protection across all levels of an organization, fostering a strong data security culture.

- Key Objectives: To protect EU residents' personal data and privacy.

- Mandatory or Voluntary: Mandatory for organizations processing EU residents' data.

- Who It Applies To: Any organization globally that processes EU residents' personal data, including U.S. companies offering services to EU citizens.

- Penalties for Non-Compliance: Fines up to €20 million or 4% of global annual turnover, whichever is higher. British Airways was fined €22 million in 2020 for a data breach in violation of GDPR.

- Helpful Resources:

GDPR Overview

6. Revised Payment Services Directive (PSD2)

Origins and Relevance: Enforced in 2018, PSD2 promotes innovation and security in online and electronic payments across the EU by encouraging open banking and enhancing consumer protections.

Compliance Challenges: Compliance with PSD2 requires adopting strong customer authentication (SCA), secure communication protocols, and robust monitoring systems to prevent fraud.

Impact on Cybersecurity Posture: PSD2 drives organizations to implement advanced authentication mechanisms and secure APIs, bolstering overall cybersecurity defenses. Its emphasis on fraud prevention enhances operational resilience.

- Key Objectives: To enhance security for online payments and protect consumers.

- Mandatory or Voluntary: Mandatory for EU financial institutions and payment service providers.

- Who It Applies To: Banks, payment institutions, and third-party payment processors within the EU. It also impacts global companies processing EU payments or offering third-party payment services to EU merchants/consumers.

- Penalties for Non-Compliance: National authorities impose fines; specifics vary by country. Non-compliance can also lead to license revocation.

- Helpful Resources:

PSD2 Compliance Guide

How to Streamline PSD2 Compliance

7. Network and Information Security Directive 2 (NIS2)

Origins and Relevance: NIS2, adopted in 2022 as an update to the original NIS Directive, is part of the EU’s efforts to bolster cybersecurity across essential services. It also indirectly impacts organizations outside the EU that provide critical services to entities covered under the directive. It expands the scope of the original directive and tightens obligations to address evolving cyber threats.

Compliance Challenges: Compliance requires detailed risk management, incident reporting within 24 hours of detection, and supply chain risk assessments. Organizations often need to upgrade their infrastructure and expand cybersecurity teams to meet these obligations.

Impact on Cybersecurity Posture: NIS2 enhances organizational resilience by requiring comprehensive risk management practices, mandatory threat reporting, and a proactive cybersecurity strategy. It also fosters collaboration between EU member states, improving incident response coordination.

- Key Objectives: To enhance cybersecurity resilience across critical sectors in the EU.

- Mandatory or Voluntary: Mandatory for critical and essential service providers.

- Who It Applies To: Essential service providers (e.g., energy, transport, finance, healthcare) and digital infrastructure providers, as well as other entities deemed important, such as postal services and waste management, in the EU. Also global providers of services critical to covered EU entities.

- Penalties for Non-Compliance: Essential entities face fines up to €10 million or 2% of global turnover, whichever is higher. Entities deemed important can incur penalties of up to €7 million or 1.4% of their total global annual turnover, whichever is higher.

- Helpful Resources:

NIS2 Directive Overview

How StrongDM Simplifies NIS2 Compliance for EU Organizations

UK Regulations

8. UK GDPR (General Data Protection Regulation)

Origins and Relevance: After Brexit, the UK adopted its own version of GDPR, specifically covering UK data, and maintaining alignment with the EU’s data protection framework to ensure business continuity and compliance for organizations operating across both regions.

Compliance Challenges: Similar to EU GDPR, compliance involves managing consent, securing data transfers, and maintaining breach notification protocols. Non-UK businesses must also appoint a UK-based representative.

Impact on Cybersecurity Posture: By emphasizing data protection, UK GDPR encourages organizations to adopt stringent cybersecurity controls like encryption, access management, and regular audits. This leads to better data governance and risk reduction.

- Key Objectives: Similar to EU GDPR but tailored for UK post-Brexit.

- Mandatory or Voluntary: Mandatory for UK-based and foreign organizations processing UK residents' data.

- Who It Applies To: UK GDPR applies to organizations processing the personal data of individuals in the UK, as well as non-UK entities offering goods or services to UK residents. Its applicability is essentially that of EU GDPR but limited to UK data subjects.

- Penalties for Non-Compliance: Standard fines: Violations, such as failing to maintain adequate records or not notifying the ICO of a data breach, may result in fines of up to £8.7 million or 2% of global turnover, whichever is greater.

Maximum fines: For more serious infringements, such as failing to obtain valid consent, violating the principles of data processing, or neglecting data subjects' rights can result in fines up to £17.5 million or 4% of global turnover, whichever is greater. - Helpful Resources:

UK GDPR Overview

9. Financial Conduct Authority (FCA) Cybersecurity Rules

Origins and Relevance: The FCA requires UK financial institutions, including banks, insurers, and investment companies, to adhere to cybersecurity standards that protect consumers and maintain market stability. Its rules emphasize risk management, governance, and operational resilience.

Compliance Challenges: Firms must integrate cybersecurity into their governance structures and provide regular reporting to the FCA. This can be resource-intensive, requiring dedicated compliance personnel and technological upgrades.

Impact on Cybersecurity Posture: FCA’s cybersecurity framework strengthens an organization’s ability to identify, mitigate, and recover from cyber incidents. It promotes proactive risk management, aligning cybersecurity strategies with business objectives.

- Key Objectives: To protect financial systems in the UK from cyber threats.

- Mandatory or Voluntary: Mandatory for FCA-regulated firms.

- Who It Applies To: All financial services firms regulated by the FCA, including banks, investment firms, and other entities.

- Penalties for Non-Compliance: FCA may impose fines, suspend licenses, or issue bans on individuals, depending on the severity of non-compliance.

For example, in 2020 the FCA fined Barclays £8 million for not adequately addressing and managing risks related to its digital operations. - Helpful Resources:

FCA Cybersecurity Guidelines

10. Bank of England's CBEST Framework

Origins and Relevance: Launched in 2014, CBEST is a threat intelligence-led penetration testing framework tailored for systemically important financial institutions (SIFIs) in the UK, such as banks, insurance companies, and financial market infrastructure providers. It is designed to evaluate the resilience of these institutions against sophisticated cyberattacks.

Compliance Challenges: CBEST assessments are rigorous, requiring collaboration with certified penetration testing firms and threat intelligence providers. Smaller institutions may struggle with the costs and complexity of implementation.

Impact on Cybersecurity Posture: By simulating advanced persistent threats (APTs), CBEST helps organizations identify vulnerabilities and improve their incident response strategies. It fosters collaboration between institutions and the government, enhancing national cybersecurity.

- Key Objectives: To enhance resilience to cyberattacks in UK financial institutions.

- Mandatory or Voluntary: Voluntary but strongly recommended for critical UK financial institutions.

- Who It Applies To: Banks and financial firms identified as critical by UK regulators.

- Penalties for Non-Compliance: No direct fines, but non-participation could lead to regulatory scrutiny, increased risk of a data breach, and damage to an entity’s reputation.

- Helpful Resources:

CBEST Overview

Asia-Pacific Regulations

11. Monetary Authority of Singapore (MAS) Technology Risk Management Guidelines

Origins and Relevance: First introduced in 2013 and updated in 2021, the MAS guidelines set comprehensive cybersecurity and technology risk management standards for financial institutions in Singapore.

Compliance Challenges: Organizations must establish robust governance frameworks, conduct regular risk assessments, and implement advanced monitoring systems. Compliance can be resource-intensive for smaller firms.

Impact on Cybersecurity Posture: By encouraging proactive risk management and continuous monitoring, the guidelines enhance operational resilience and customer trust. They also promote innovation by ensuring secure adoption of digital technologies.

- Key Objectives: To strengthen IT systems and operational resilience in Singapore's financial institutions.

- Mandatory or Voluntary: Adherence to the guidelines, though strongly encouraged by MAS, is voluntary.

Who It Applies To: Financial institutions, including banks, insurance firms, capital market intermediaries, including brokerage firms and asset managers, and payment service providers licensed in Singapore. It also indirectly applies to third-party service providers based outside Singapore engaged by these entities. - Penalties for Non-Compliance: None are imposed for non-compliance, however MAS strongly encourages adherence to avoid security risks that may subsequently result in penalties or fines.

Helpful Resources:

MAS Technology Risk Management Guidelines

12. Reserve Bank of India (RBI) Cybersecurity Framework

Origins and Relevance: Introduced in 2016, RBI’s Cybersecurity Framework sets baseline security standards for banks and financial institutions in India to combat the increasing threat of cyberattacks.

Compliance Challenges: Banks must implement continuous risk assessments, monitor third-party vendors, and ensure timely reporting of cyber incidents. Smaller banks may face challenges in allocating resources for compliance.

Impact on Cybersecurity Posture: The framework fosters a culture of vigilance by requiring banks to adopt threat intelligence, incident response plans, and periodic audits. It strengthens the sector’s resilience to emerging threats.

- Key Objectives: To improve IT security, protect customer data, and ensure resilience in India’s banking sector.

- Mandatory or Voluntary: Mandatory for Scheduled Commercial Banks in India.

- Who It Applies To: A scheduled commercial banks in India operating under RBI's jurisdiction, including foreign banks with Indian branches. While not directly imposed on them, foreign service providers may need to adhere to it as part of their contractual obligations with Indian banks.

- Penalties for Non-Compliance: Fixed monetary fines are not outlined in the regulation, but typically range from INR 1 crore to INR 2 crore (approx. USD 120,000 to USD 240,000), depending on severity of non-compliance. Non-compliance can also result in RBI restricting operations or imposing additional audits.

- Helpful Resources:

RBI Cybersecurity Framework

Global/Industry-Specific Frameworks

13. ISO/IEC 27001 and 27002

Origins and Relevance: As global benchmarks for information security, these ISO standards provide a comprehensive framework for managing sensitive data. Though voluntary, ISO certification is often a prerequisite for partnerships in highly regulated sectors like financial services. It demonstrates a commitment to safeguarding client data and meeting international expectations.

Compliance Challenges: Achieving certification can be resource-intensive, requiring organizations to establish comprehensive security policies, perform risk assessments, and demonstrate continuous improvement in security practices.

Impact on Cybersecurity Posture: ISO 27001 and 27002 foster a structured approach to managing sensitive data and improving security resilience. The frameworks drive organizations to implement strong controls, conduct regular audits, and ensure compliance with legal and regulatory requirements.

- Key Objectives: To establish a comprehensive information security management system (ISMS) and protect sensitive information.

- Mandatory or Voluntary: Voluntary but widely adopted as a global standard.

- Who It Applies To: Any organization aiming to establish, implement, maintain, and improve an information security management system (ISMS). ISO/IEC 27002 provides guidelines for organizational information security practices. It is often required for vendors in critical sectors like finance.

- Penalties for Non-Compliance: No direct penalties, but lack of certification can result in lost business opportunities and reputational harm.

- Helpful Resources:

ISO 27001 Compliance: Complete Guide

How StrongDM Helps with ISO 27001 Compliance

Understanding ISO 27001 Controls [Guide to Annex A]

ISO 27001 Audit: Everything You Need to Know

ISO 27001 Checklist: 10-Step Implementation Guide

How Much Does ISO 27001 Certification Cost?

How to Maintain ISO 27001 Certification

14. Basel Committee on Banking Supervision (BCBS) Guidelines

Origins and Relevance: BCBS guidelines are non-binding but widely adopted by global financial institutions to enhance cybersecurity and operational resilience. They aim to ensure the stability of the global financial system by providing clear expectations for managing technology risks, including cybersecurity. The guidelines have a pronounced influence on national regulations in member countries, shaping how financial organizations manage IT risks. Aligning with BCBS standards ensures compliance with local laws while showcasing a robust cybersecurity posture.

Compliance Challenges: Implementing BCBS guidelines requires significant investment in technology, resources for training staff, and alignment of governance structures. Smaller institutions may face challenges in meeting the high standards set by the guidelines.

Impact on Cybersecurity Posture: Adopting BCBS guidelines strengthens cybersecurity defenses by focusing on risk management, resilience planning, and operational continuity. Institutions that align with these standards build a robust cybersecurity culture and improve their ability to withstand cyber threats.

- Key Objectives: To promote stability in global banking systems by strengthening IT governance and operational resilience.

- Mandatory or Voluntary: Voluntary, but member nations often adopt BCBS guidelines into their regulatory frameworks.

- Who It Applies To: Financial institutions, particularly banks, in jurisdictions under BCBS member nations. It may indirectly impact global organizations working with these institutions, for example, through expectations that they meet similar cybersecurity standards.

- Penalties for Non-Compliance: No direct penalties, but non-compliance with local adaptations (e.g., NYDFS or MAS guidelines) may result in fines, license revocations, or reputational damage.

- Helpful Resources:

BCBS Overview

15. Cybersecurity Requirements for Financial Market Infrastructures (CPMI-IOSCO)

Origins and Relevance: These requirements, set by global standard-setting bodies, aim to secure financial market infrastructures critical to the global economy, ensuring maintenance of a secure and resilient operational environment. Adopting CPMI-IOSCO standards helps financial institutions organizations meet compliance expectations in multiple jurisdictions while reinforcing operational security.

Scope and Applicability: CPMI-IOSCO applies to financial market infrastructures such as payment systems, central securities depositories, and trading platforms, ensuring that these entities maintain a secure and resilient operational environment.

Compliance Challenges: Compliance involves adopting comprehensive cybersecurity frameworks, ensuring robust risk management practices, and performing regular security assessments. Organizations must integrate these requirements into their operational processes, which can be resource-intensive.

Impact on Cybersecurity Posture: By adhering to CPMI-IOSCO standards, financial institutions and market infrastructures enhance their resilience against cyber threats, ensuring the security and integrity of financial transactions on a global scale. The framework emphasizes continuous monitoring and recovery planning.

- Key Objectives: To ensure the security and resilience of financial market infrastructures (FMIs) against cyber threats.

- Mandatory or Voluntary: Voluntary, but widely implemented as best practices by FMIs globally. National regulators or authorities may require FMIs within their jurisdiction to demonstrate adherence to these principles, especially when seeking authorization or operating licenses.

- Who It Applies To: Payment systems, central securities depositories, central counterparties, trade repositories, and securities settlement systems globally.

- Penalties for Non-Compliance: While CPMI-IOSCO guidelines are voluntary, non-compliance can result in reputational harm and operational restrictions imposed by local regulators who have integrated these standards into their regulatory frameworks.

- Helpful Resources:

CPMI-IOSCO Overview

Challenges in Meeting Financial Cybersecurity Regulations

If the number of cybersecurity regulations itself weren’t daunting enough, confusion may result from frameworks requiring different levels of testing, reporting methods, timeframes for data retention and deletion, and so on. Each regulation introduces its own requirements that, if not fully met, can lead to compliance gaps or inefficiencies.

Adhering to all applicable cybersecurity regulations is one part of the challenge facing financial institutions. Adopting technologies that don’t complicate the task of compliance even further, is the other part.

Key Challenges in Cybersecurity Compliance for Financial Services:

- Streamlining compliance: Regulations may require extensive reporting, frequent vulnerability scans, and maintaining up-to-date asset inventories. Integrating these requirements into a unified system can be difficult, especially when frameworks vary across jurisdictions.

- Minimizing operational disruptions: Achieving compliance often involves implementing new security technologies to meet mandates. These implementations risk disrupting business operations, increasing downtime, or overburdening staff with additional tasks.

- Centralized access management: Compliance mandates might require secure and centralized control of access to sensitive data and systems. Implementing such controls across modern cloud environments, databases, and Kubernetes clusters can be costly and complex, particularly when hybrid systems lack interoperability.

- Detailed auditing capabilities: Many cybersecurity regulations demand comprehensive logging and auditing of all user activities. Meeting these requirements involves deploying tools to track and log user sessions in real time, which can strain IT resources and create additional costs for storage and analysis.

- Granular access control: Regulatory frameworks frequently emphasize the need for least-privilege and zero-trust models. Configuring systems to enforce these principles while dealing with fragmented legacy technologies can pose a challenge.

Streamlining FinServ Compliance with StrongDM

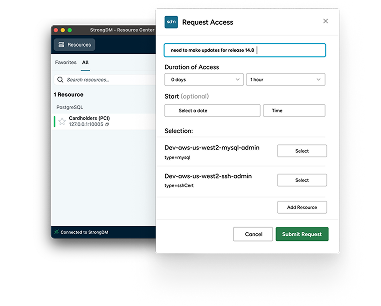

To meet the demands of increasingly complex cybersecurity regulations, financial services providers require technologies that adapt to and simplify evolving security processes. Tools that centralize, automate, and streamline security and auditing functions, such as identity and access management (IAM) software, simplify compliance. They ensure that financial institutions meet monitoring, auditing, and reporting requirements while strengthening security and operational efficiency to their overall advantage. Such technologies are at the core of StrongDM’s advanced, user-friendly IAM solutions.

StrongDM supports enterprise security, compliance, and operations teams by providing:

- Centralized Access Management: Simplifies and secures access to databases, servers, and Kubernetes clusters.

- Detailed Auditing: Tracks and logs every user session in real time, meeting the audit and reporting requirements of many regulations.

- Granular Access Control: Ensures users access only what they need, supporting least-privilege principles and zero-trust frameworks.

- Ease of Compliance: Reduces the operational burden of compliance by streamlining security controls and access audits.

By using StrongDM, financial institutions can meet tough cybersecurity regulations with ease. Our secure, easy-to-use access-management solutions ensure centralized access control, adhere to the principle of least privilege, streamline user access, and protect critical systems and data from unauthorized activities. With StrongDM, organizations can confidently comply with regulations, avoid penalties, and maintain a robust security posture.

Schedule a free demo today to see StrongDM in action.

Next Steps

StrongDM unifies access management across databases, servers, clusters, and more—for IT, security, and DevOps teams.

- Learn how StrongDM works

- Book a personalized demo

- Start your free StrongDM trial

Categories:

About the Author

John Martinez, Technical Evangelist, has had a long 30+ year career in systems engineering and architecture, but has spent the last 13+ years working on the Cloud, and specifically, Cloud Security. He's currently the Technical Evangelist at StrongDM, taking the message of Zero Trust Privileged Access Management (PAM) to the world. As a practitioner, he architected and created cloud automation, DevOps, and security and compliance solutions at Netflix and Adobe. He worked closely with customers at Evident.io, where he was telling the world about how cloud security should be done at conferences, meetups and customer sessions. Before coming to StrongDM, he lead an innovations and solutions team at Palo Alto Networks, working across many of the company's security products.

You May Also Like