What Is a Compliance Audit? Process, Examples, and How to Prepare

Written by

StrongDM TeamLast updated on:

September 22, 2025Reading time:

Contents

Built for Security. Loved by Devs.

- Free Trial — No Credit Card Needed

- Full Access to All Features

- Trusted by the Fortune 100, early startups, and everyone in between

From HIPAA and SOC 2 to PCI-DSS and ISO 27001, compliance audits are no longer just checkboxes, they’re essential to doing business. But between evidence collection, access reviews, and control enforcement, even well-prepared teams get buried in spreadsheets and audit stress.

This guide breaks down the types of compliance audits (regulatory, security, financial, and operational), the frameworks they map to, and the real challenges most teams face, like privileged access sprawl and manual tracking.

You will also learn how to make audits radically simpler with centralized access control, real-time logging, and just-in-time permissions, enabling audit-ready visibility without the manual overhead.

What Is a Compliance Audit?

A compliance audit is a structured review that verifies whether an organization is following required laws, regulations, standards, and internal policies. These audits go beyond being regulatory “checkboxes” they are essential to doing business in industries that demand proof of security, financial accuracy, or operational integrity.

During a compliance audit, auditors evaluate evidence such as system logs, access control records, security policies, and operational procedures to confirm that documented controls exist and function properly. Depending on the industry, audits may focus on different areas:

-

Regulatory audits (e.g., HIPAA for healthcare, SOX for financial reporting)

-

Security audits (e.g., ISO 27001, SOC 2, PCI-DSS for data protection)

-

Financial audits (validating financial reporting and internal controls)

-

Operational audits (ensuring day-to-day processes align with safety, quality, and contractual requirements)

The purpose of a compliance audit is to reduce risk, prove trustworthiness, and ensure that an organization’s processes meet legal, security, and industry standards. A successful audit strengthens security posture, builds credibility with customers and regulators, qualifies a company for certifications, and reduces risk by surfacing vulnerabilities before they become liabilities.

Types of Compliance Audits

There are numerous compliance frameworks and regulations, along with corresponding audits. Depending on your industry and operations, your organization can be required to do more than one type of compliance audit:

Regulatory Compliance Audits

Regulatory compliance audits assess whether your organization complies with government regulations or industry mandates. They are often required by law, and failure to pass them can lead to fines or legal consequences.

If you’re a healthcare provider, for example, you must pass the HIPAA compliance audit to verify that your organization protects patient privacy and secures health data. Publicly traded companies undergo Sarbanes-Oxley (SOX) audits to validate the integrity of their financial reporting and detect potential corporate fraud.

Security Compliance Audits

Security compliance audits focus on how well your organization protects data and digital infrastructure. They assess whether you’re meeting industry-specific cybersecurity standards, such as:

When your organization handles credit card payments, for instance, you may undergo the PCI-DSS audit to verify secure handling of payment information.

Financial Compliance Audits

Financial compliance audits evaluate the integrity of your financial reporting against the required standards. For publicly traded companies, an SOX audit may be necessary to assess the reliability of their financial statements and the effectiveness of their internal controls. Nonprofits and government contractors may also undergo a financial audit to verify the responsible use of funds and compliance with guidelines.

Operational Compliance Audits

An operational compliance audit reviews whether your company’s processes and systems align with internal policies and contractual obligations. It can also check how well your business day-to-day activities support safety and quality. For example, manufacturers undergo operational audits to assess compliance with OSHA safety protocols and production quality standards.

Common Compliance Frameworks That Require Auditing

The framework your organization is audited against largely depends on your industry and the type of data you handle. Each comes with specific requirements that auditors use to assess compliance.

Here are commonly audited frameworks and what auditors typically look for in each:

| Compliance Framework | Who Needs to Complete a Compliance Audit? | What Auditors Look For |

| HIPAA | Businesses in the healthcare industry |

|

| GDPR | Organizations handling data of EU residents |

|

| SOC 2 | SaaS, cloud, and service providers |

|

| SOX | Publicly traded companies |

|

| ISO 27001 | Organizations seeking certification for their information security program |

|

| PCI-DSS | Businesses handling credit card payments |

|

| FISMA | Federal agencies and contractors |

|

The Compliance Audit Process

Conducting a compliance audit involves several key steps:

1. Planning

Define the audit’s scope based on applicable frameworks. Planning lays the groundwork for the entire audit process, so involve all relevant stakeholders from the start. Then, create a compliance audit checklist that maps your specific framework.

For internal audits, assemble a team of qualified auditors with expertise in relevant areas. If it’s an external audit, coordinate with the auditing firm to align on scope and avoid surprises later.

2. Data collection

Gather the evidence that auditors need to evaluate compliance. Depending on the audit, the data can include:

- System logs

- Access control records

- Security policies

- Employee training log

- Documentation of operational procedures

Centralize all evidence to simplify the audit and prevent red flags that trigger deeper scrutiny.

3. Testing and validation

Auditors assess whether your organization has documented controls and if they function. The process may involve walkthroughs, control sampling, interviews, and in some cases, technical testing such as vulnerability scans or configuration reviews.

4. Reporting

Auditors compile their findings into a formal report, outlining tested controls, compliance gaps, control weaknesses, supporting evidence, and recommendations for remediation.

5. Remediation

When audits reveal non-compliance, develop a remediation plan. Assign people to each remediation task and track progress to closure.

Compliance Audit Preparation Checklist

Most organizations see compliance as critical to their success, yet 68% still struggle in practice . To be ready when auditors come knocking, create a compliance audit checklist that aligns your operation with requirements auditors will scrutinize.

Pre-Audit Checklist

- Define audit scope and responsible stakeholders.

- List relevant compliance frameworks such as SOC 2, ISO 27001, PCI-DSS, or HIPAA, and map key requirements.

- Inventory systems, assets, processes, and data that are subject to review.

- Confirm access control and data protection policies are documented and current.

- Gather previous audit reports and remediation actions.

During the Audit

- Provide clear access to systems and documentation.

- Make team members available for auditors’ questions.

- Track all evidence provided and responses given.

- Log all access and configuration changes.

Post-Audit

- Review the auditors’ findings and recommendations.

- Prioritize and assign remediation tasks.

- Update policies and configurations accordingly.

- Schedule the next internal review or compliance check.

- Store audit evidence securely for future reference.

Common Challenges Organizations Face During Audits

To navigate a compliance audit successfully, you must first recognize common challenges and develop a strategy to address them head-on.

Manual Tracking

Using spreadsheets to track controls and evidence slows audits and increases the risk of missing important documentation. Use a centralized system or GRC tool to automate tracking so you can respond faster to auditors’ requests and reduce audit fatigue.

Disparate Access Controls

Over 80% of organizations manage access rights across environments and teams. This fragmented approach causes inconsistencies that are hard to justify during an audit. To address this challenge, use a centralized identity and access management tool like StrongDM that unifies access across infrastructure and enforces least privilege via role-based access control.

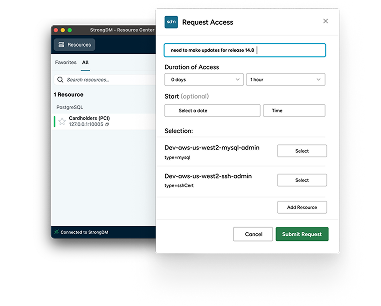

Privileged User Oversight

Auditors scrutinize privileged access because it poses the highest risk. Yet, 85% of privileged credentials go unused for 90 days, and nearly one in three users have permissions they never exercise, creating gaps that auditors quickly flag. With a solution like StrongDM, you can enforce just-in-time access and eliminate unused privileges to prove least privilege and maintain full visibility during audits.

No Continuous Monitoring

Over half of organizations struggle to move beyond manual point-in-time compliance processes. In fact, 95% of business leaders admit their compliance programs aren’t optimized for continuous maturity.

Without continuous monitoring, enforcement becomes inconsistent and safeguards outdated, both of which auditors quickly flag. Adopt continuous control monitoring tools to help maintain year-round audit readiness.

Benefits of a Successful Compliance Audit

When you pass a compliance audit, your company unlocks more than just regulatory checkmarks:

Stronger Security Posture

A successful audit confirms that your security controls are adequate to defend against real-world attacks. For instance, organizations that pass NIST CSF and ISO 27001 experience a 75.8% reduction in cyber exploits . Those who conduct regular audits see a 38-45% drop in identified vulnerabilities.

Trust and Credibility

Compliance is evolving from mere obligation to a strategic asset. Beyond passing audits, compliance builds trust and credibility with customers, suppliers, investors, and regulators. It signals that your organization takes risks and responsibility seriously.

Eligibility for Certifications

Frameworks like CMMC, HIPAA, SOC 2, and ISO 27001 require formal audits. Passing them unlocks business in regulated industries and public sector contracts. For instance, CMMC is mandatory for working with the U.S. Department of Defense and must be verified through an authorized assessment.

Risk Reduction

A successful audit reveals hidden vulnerabilities before they become liabilities. It gives you the chance to fix threats early and strengthen weak spots.

Compliance Audit Real-World Example

The Challenge: SOC 2 Audit Readiness at Coveo

Coveo, a leading AI-powered search and personalization platform, needed to maintain SOC 2 compliance to win and keep enterprise customers. But:

- Access was fragmented across multiple environments.

- Teams relied on manual evidence collection (spreadsheets + log exports).

- Each audit cycle meant days of preparation and risk of missed documentation.

- Privileged access was difficult to track, enforce, and justify.

Before StrongDM

| Problem Area | What It Looked Like | Impact on Audits |

| Evidence Collection | Spreadsheets + manual log exports | Time-consuming, error-prone |

| Access Reviews | Siloed tools per environment | Inconsistent, hard to prove least privilege |

| Privileged Access | Standing permissions for many users | Auditors flagged risk |

| Audit Prep Time | Days of digging & assembling reports | Slowed down engineers, added stress |

After StrongDM

- Centralized Access Control → One platform for all databases, servers, and environments.

- Real-Time Audit Logs → Every session, query, and permission change automatically recorded.

- Just-in-Time Access → Privileged credentials granted only when needed, then revoked.

- Audit-Ready Evidence → Exportable reports in minutes instead of days.

| With StrongDM | Result |

| Unified access platform | No more fragmented IAM controls |

| Automatic, complete logs | Evidence instantly available for auditors |

| JIT privileged access | Auditors see least privilege enforcement in action |

| Continuous compliance monitoring | Audit readiness year-round, not just at audit season |

The Outcome for Coveo

- Audit prep time reduced from days → minutes.

- SOC 2 compliance became a continuous state instead of a fire drill.

- Engineers saved time and focused on product innovation instead of compliance busywork.

- Auditors gained clear, consistent visibility without back-and-forth clarifications.

Learn more about how Coveo transformed compliance from a burden into a business enabler with StrongDM.

Simplify Compliance Audits with StrongDM

Audits don’t have to mean sleepless nights, endless spreadsheets, and scrambling for evidence. With StrongDM, audit readiness becomes a continuous state, not a fire drill. Here’s how we help:

- Centralized Access Control: Replace siloed IAM tools with one platform that unifies access across databases, servers, and Kubernetes clusters, making least privilege enforceable and auditable.

- Audit-Ready Logs, Automatically: Every query, every session, every permission change is captured in real time. No more hunting through logs, the evidence is at your fingertips.

- Just-in-Time Privileged Access: Grant elevated permissions only when needed, then automatically revoke them. Auditors love it, attackers hate it.

- Continuous Compliance Monitoring: Stay compliant all year round, not just during audit season. StrongDM keeps your controls live, visible, and verifiable.

- Framework Alignment Made Easy: Whether it’s HIPAA, SOC 2, PCI-DSS, ISO 27001, or SOX, StrongDM seamlessly maps to the access control requirements auditors scrutinize.

No more audit fatigue. No more privileged access sprawl. Just simplified, streamlined compliance.

Book a demo today to see how StrongDM makes passing your next audit the easiest one yet.

Compliance Audits: Frequently Asked Questions

What is the purpose of a compliance audit?

To verify that an organization is following required laws, regulations, standards, and internal policies—helping reduce risk, prove trustworthiness, and ensure security, financial accuracy, or operational integrity.

What is a compliance audit checklist?

A structured list of tasks, evidence, and controls aligned with specific compliance frameworks (like SOC 2, HIPAA, or PCI-DSS) used to prepare for, conduct, and follow up on an audit.

Who performs a compliance audit?

Compliance audits are performed by qualified internal auditors or third-party external auditors, depending on the framework and whether certification or regulatory validation is required.

Next Steps

StrongDM unifies access management across databases, servers, clusters, and more—for IT, security, and DevOps teams.

- Learn how StrongDM works

- Book a personalized demo

- Start your free StrongDM trial

Categories:

About the Author

StrongDM Team, Universal Privileged Access Authorization (UPAA), the StrongDM team is building and delivering a Zero Trust Privileged Access Management (PAM), which delivers unparalleled precision in dynamic privileged action control for any type of infrastructure. The frustration-free access stops unsanctioned actions while ensuring continuous compliance.

You May Also Like